Mastering the Art of Changing a Stop Loss Order

In the world of trading, risk management is a fundamental aspect that every trader should master. One of the key tools in a trader's arsenal is the stop loss order. Understanding how to effectively manage and change a stop loss order can significantly impact your trading strategy. This article will explore the ins and outs of changing a stop loss order, including practical tips and strategies for optimizing its effectiveness. To begin, let’s delve into what a stop loss order is and why it is crucial in trading. For more insights, you can check out changing a stop loss order after it's placed on primexbt PrimeXBT location.

What is a Stop Loss Order?

A stop loss order is a predetermined price level you set to limit potential losses on a trade. Essentially, it is an order to sell a security when it reaches a specific price, thus preventing further losses in the event of adverse market movements. For example, if you buy a stock at $100 and set a stop loss at $90, your position will automatically be sold if the stock falls to that level, limiting your loss to $10 per share.

Importance of Changing a Stop Loss Order

While setting a stop loss order is a critical first step, it is equally important to regularly review and potentially change that order based on market conditions. Several factors may necessitate changing your stop loss order:

- Market Volatility: In volatile markets, prices can swing dramatically, potentially triggering stop loss orders prematurely. Adjusting your stop loss can help align it with current market conditions.

- Profit-Locking: If your trade moves in your favor, you may want to change your stop loss to a higher level to protect profits. This is often referred to as a trailing stop loss.

- New Support and Resistance Levels: As market conditions change, new support and resistance levels may emerge. Adjusting your stop loss to align with these levels can improve your chances of staying in a winning trade.

How to Change a Stop Loss Order

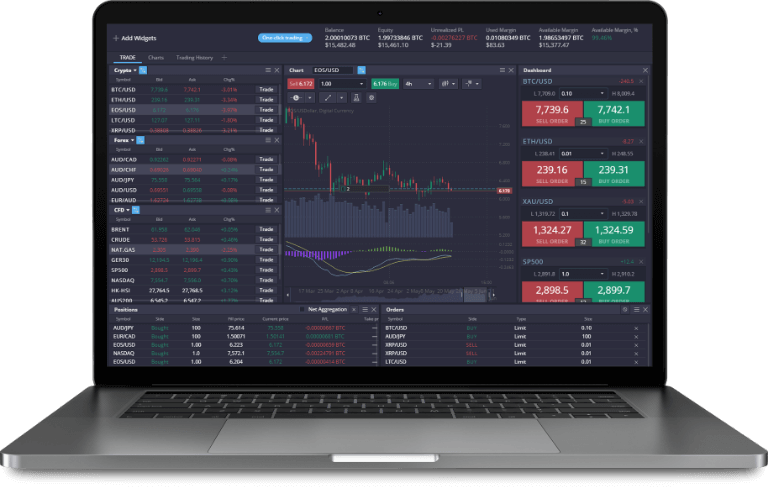

Changing a stop loss order is usually a straightforward process, though the exact steps may vary depending on your trading platform. Here is a general guide on how to change your stop loss order:

- Log into Your Trading Account: Start by logging into your trading account on your chosen platform.

- Navigate to Your Open Positions: Go to the section of the platform where you can view your current open positions or trades.

- Select the Position: Locate the position for which you want to change the stop loss order and select it.

- Edit the Stop Loss Order: Look for an option to edit or modify your stop loss order. You may be able to adjust the stop loss price either by dragging it on a chart or entering a new value into a designated field.

- Confirm the Changes: Once you have made the desired adjustments, ensure that you save or confirm the changes to your stop loss order. It’s crucial to verify that your new stop loss level is correctly set.

Strategies for Setting and Changing Stop Loss Orders

Here are some strategic considerations for setting and modifying your stop loss orders:

- Determine Your Risk Tolerance: Before you open a trade, establish how much risk you are willing to take on that position. Use that figure to set your initial stop loss.

- Use Technical Analysis: Incorporate technical analysis tools like moving averages, trend lines, and Fibonacci retracements to identify optimal stop loss levels.

- Implement Trailing Stops: A trailing stop moves with the market price, allowing you to lock in profits as the price rises while still protecting your downside.

- Be Prepared for Volatility: In highly volatile markets, consider setting your stop loss a bit wider to prevent it from getting triggered by normal price fluctuations.

Common Mistakes When Changing Stop Loss Orders

Even experienced traders can make mistakes when changing their stop loss orders. Here are some common pitfalls to avoid:

- Being Too Tight: Setting stop losses too close to the entry point can lead to getting stopped out too early during normal market noise.

- Ignoring Market Conditions: Failing to adjust your stop loss in response to changing market conditions can expose you to unnecessary risk.

- Emotional Decision-Making: Letting fear or greed influence your stop loss decisions can lead to poor outcomes. Stick to your trading plan.

Conclusion

Changing a stop loss order is not merely a procedural step; it is a strategic decision that can help minimize losses and maximize gains. Regularly reassessing your stop loss levels in response to market conditions, maintaining discipline, and implementing sound trading strategies can lead to more effective risk management. By mastering the art of changing a stop loss order, you put yourself in a better position to succeed in the dynamic world of trading.

כתיבת תגובה

You must be logged in to post a comment.