In the fast-paced world of forex trading, the right software can make all the difference between success and failure. Traders are constantly on the lookout for reliable and efficient tools that can help them analyze market trends, execute trades swiftly, and manage risks effectively. In this article, we will explore the best forex trading software available on the market today, including a brief mention of best forex trading software Qatari Trading Platforms that offer unique features suited for both beginners and experienced traders.

Understanding Forex Trading Software

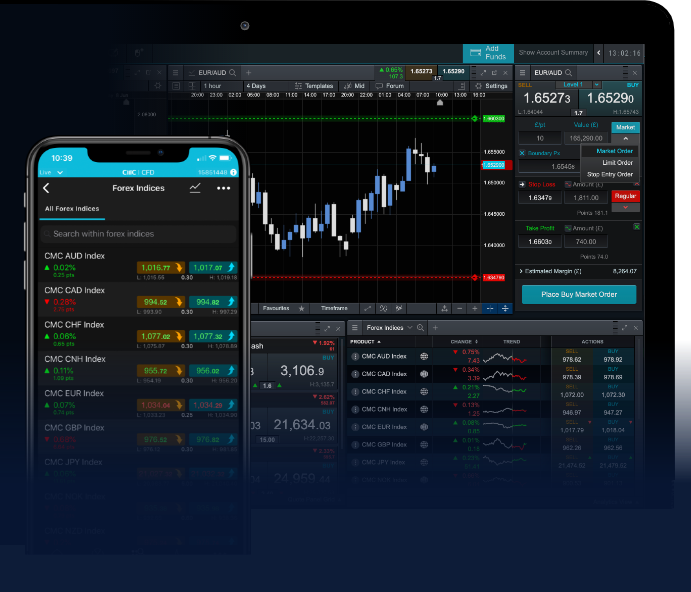

Forex trading software, often referred to as trading platforms, is a critical component for those looking to engage in currency trading. These platforms provide various functionalities, including real-time market data, charting tools, technical analysis indicators, and trade execution capabilities. When choosing the right trading software, traders should consider factors like user interface, available features, compatibility with devices, and the quality of customer support.

Key Features to Look for in Forex Trading Software

- Charting Tools: Advanced charting tools provide several technical indicators and customizable charts that help traders visualize price movements and identify trends.

- User-Friendly Interface: Traders of all levels should look for platforms that are intuitive and easy to navigate, reducing the learning curve.

- Real-Time Market Data: Access to real-time quotes and market news is essential to make informed trading decisions.

- Automated Trading: Features like algorithmic trading allow traders to automate their trading strategies, saving time and reducing emotional decision-making.

- Risk Management Tools: Essential for preserving capital, features such as stop-loss orders and take-profit levels help manage risk effectively.

- Mobile Compatibility: Mobile apps or mobile-friendly versions of platforms allow traders to access their accounts and trade while on the go.

Top Forex Trading Software Options

1. MetaTrader 4 (MT4)

MetaTrader 4 is one of the most popular trading platforms used globally, particularly due to its versatility and comprehensive features. It offers an extensive range of technical analysis tools, supports automated trading through Expert Advisors (EAs), and has a robust community of users. Furthermore, its availability on both desktop and mobile makes it accessible for traders anywhere, any time.

2. MetaTrader 5 (MT5)

MetaTrader 5 is the updated version of MT4 and includes several enhancements, such as more advanced trading capabilities and additional timeframes. MT5 is also equipped with improved analytical tools and allows for trading on various assets beyond forex, making it a versatile choice for those interested in diversifying their portfolios.

3. cTrader

cTrader is known for its superior user interface and fast execution speeds. It provides features such as cAlgo, which facilitates automated trading through the creation of custom algorithms. cTrader also offers intuitive charting tools and is particularly praised for its transparency regarding spreads and commissions.

4. NinjaTrader

NinjaTrader caters primarily to active traders and is well known for its advanced charting capabilities and analytics. It provides a range of features for both trading and backtesting strategies, making it a solid choice for those serious about quantitative trading.

5. TradingView

While trading execution must be done through a broker, TradingView is a powerful charting and social networking platform that allows traders to analyze markets collaboratively. Its user-generated ideas, and the ability to share analysis with others make it a valuable resource for traders of all levels.

Comparing Software: Pros and Cons

| Platform | Pros | Cons |

|---|---|---|

| MetaTrader 4 | Widespread use, robust features, free | Outdated interface, limited order types |

| MetaTrader 5 | Multiple asset classes, improved analytics | Not all brokers support it |

| cTrader | User-friendly, fast execution | Less popular, fewer available brokers |

| NinjaTrader | Advanced features for experienced traders | Can be overwhelming for beginners |

| TradingView | Excellent charting tools, social features | No direct trading, relies on brokers |

Choosing the Right Software for You

The best forex trading software for you largely depends on your personal trading style, preferences, and experience level. Beginners might prefer platforms that offer educational resources and straightforward interfaces, while advanced traders may seek more analytical tools and customizable features.

Before committing to a platform, take advantage of free trials or demo accounts. This allows you to test the software's functionality and see how well it fits with your trading strategy without risking real money.

Conclusion

In conclusion, selecting the right forex trading software is a critical decision that can significantly impact your trading success. Whether you opt for the versatile MetaTrader 4 or the advanced NinjaTrader, each platform has unique features tailored to different trader needs. Always ensure to research and test software thoroughly before making a commitment, as the best tool for you will ultimately align with your trading goals and style.